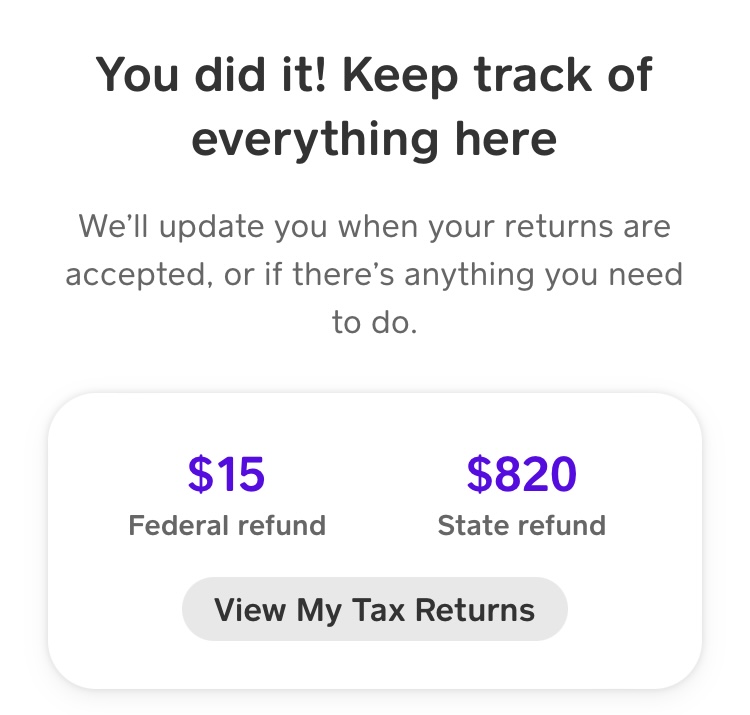

Sometimes when I talk about earning credit card points, I get asked about the amount of debt I have and what the interest rate is on my cards. The answer is I only carry a balance when I have a 0% offer. I use my regular expenses to get points and always look for ways to maximize earning. One way to do that is by paying taxes. The website Doctor of Credit has a great guide on how to pay federal taxes and earn points. In Arizona, there’s an additional way to get points during tax season. Arizona offers a number of tax credits for donations made to qualifying charities, foster care agencies, and public schools amongst others. Each year I work on one of my sign up bonuses with these donations. It’s an easy way to meet the requirements of the bonus without having to spend any extra money. A warning: this does require being able to float the money while the refund is processed otherwise you’ll pay interest and wipe out all the points you just earned.

Disclaimer: This does not constitute tax advice. Check with a tax professional for any tax-related questions.