One way to earn credit card rewards without increasing what you spend is to buy gift cards strategically. Grocery stores and pharmacies typically sell gift cards and those stores usually are in higher credit card rewards categories. The Citi Custom Cash is 5% back on the first $500 spent each month in your highest category which includes grocery stores and pharmacies. Other cards like Chase Freedom and Discover It have rotating 5% categories that frequently feature grocery stores and pharmacies. All three cards come with no annual fee.

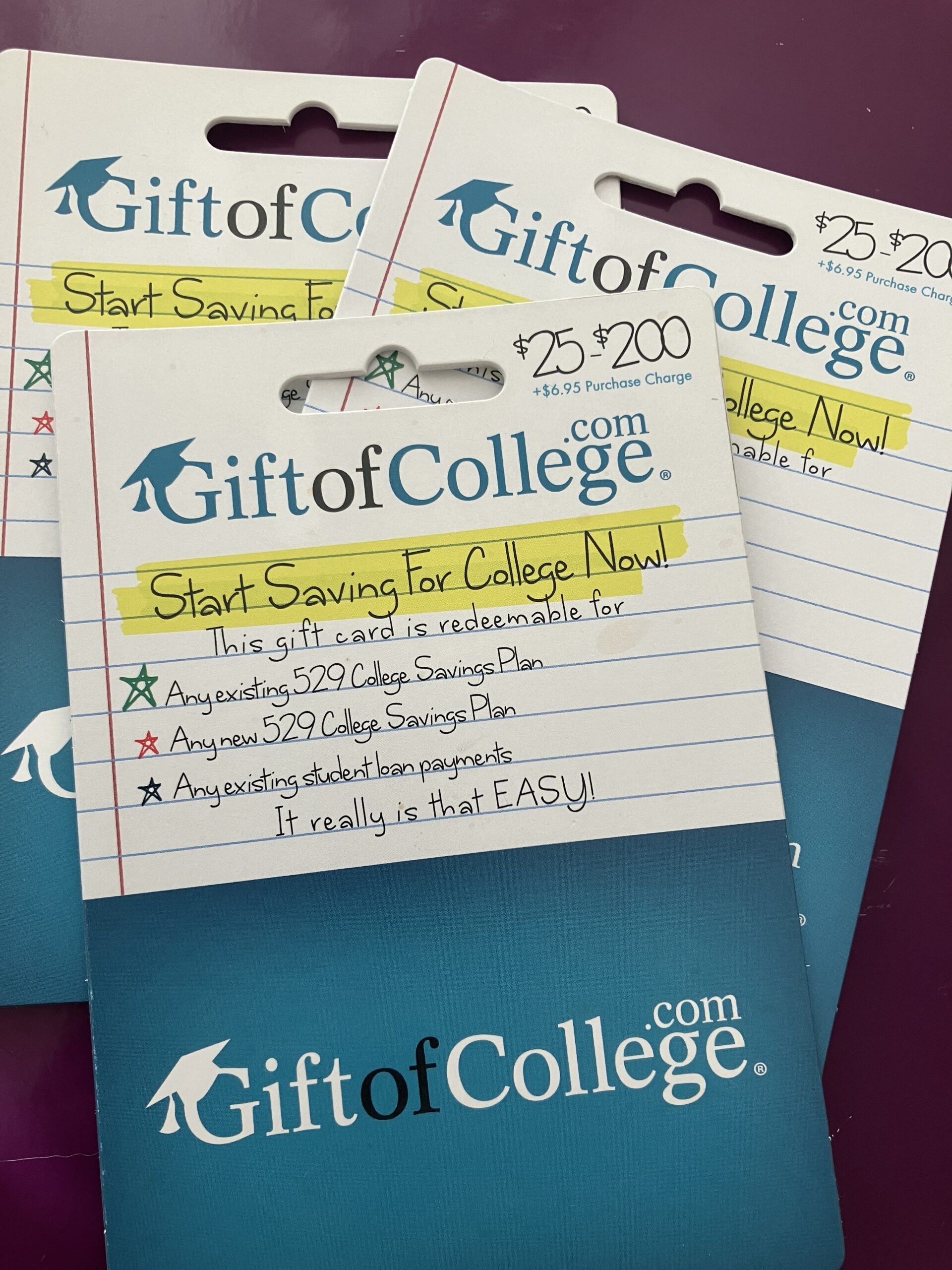

One great gift card purchase is Gift of College. Normally paying a student loan or funding a 529 account wouldn’t result in credit card rewards as those are usually cash only, but Gift of College makes it possible to earn some points. Although these gift cards do have a fee, using a card that earns 5% back makes it worth the cost. When I was paying off my student loans I frequently bought the Gift of College cards for the bonuses. The more lucrative deal of the $500 card is now rare, but a $200 card with a $6.95 fee at CVS purchased with 5% back makes sense. It’s an easy way to earn some points on regular expenses.

Now that the loans are paid off, I look for other opportunities to maximize. For example, purchasing a Starbucks card at a grocery store that awards fuel points while also using a high earning credit card is a nice way to make a Starbucks treat more affordable. Especially when that Starbucks purchase can be made on a double points day or when a bonus is being offered. This strategy also works for streaming services, department stores, and plenty of others that offer gift cards.