At the start of August I finished up the $5,000 spend I needed to get the retention bonus on the American Express Business Platinum (referral link) which was 15,000 Membership Rewards. It lined up with another bonus they had for 1,500 Membership Rewards. Along with the spend, that added 20,995 to my total. Without the retention, I would’ve canceled the card, but now there are rumors of hotel benefits being added (along with an increased annual fee) so I’m glad to have it one more year at the current annual fee to see what changes will be made.

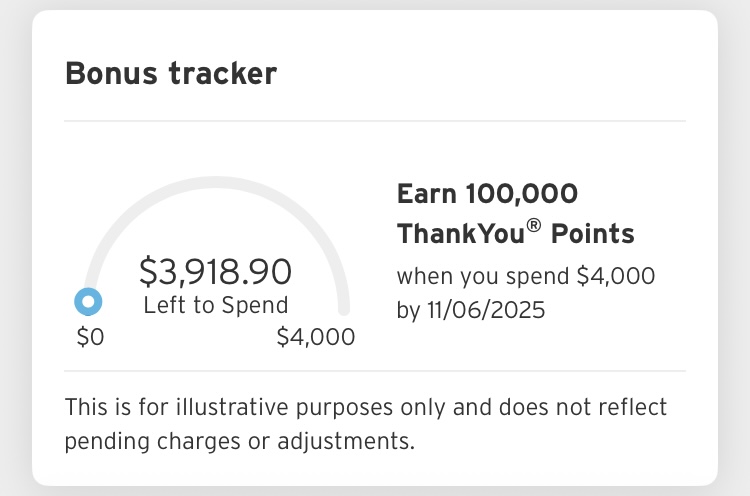

In June I was disappointed to not be able to get a bonus on the revamped Chase Sapphire Reserve, but it turns out that was for the best as this month I was approved for the 100,000 Thank You points bonus on Citi’s new Strata Elite card.

The card has a $595 annual fee in contrast to $795 for the Reserve. Even better, Citi made the benefits that come with this card easy to use and far more valuable for my life. There’s a $200 “splurge” credit that kind of seems made for me because it can be used for Live Nation. I’ve already bought concert tickets and had the charge reimbursed. I’ve just started working on this one, so I only added 840 points to my Citi balance.

This was a lighter month in rewards from non-credit card programs. I think I’m running up against the household limits for the no alcohol purchase beer rebates. This month I had $17 in prepaid MasterCards from that program. I’m hoping everything resets in 2026. I also had enough Swagbucks (referral link) to get a $25 prepaid card that I turned into Uber (referral link) credit for my Disneyland trip next month. I added a bit to my Amazon gift card total too. From Microsoft Rewards (referral link) and Checkpoints I had $10 each and Amazon’s Shopper Panel added another $3.32.